This guide, including the FAQs below, will help you understand the Florida health insurance options available to you and your family. Many people find that an Affordable Care Act (ACA) Marketplace plan – or Obamacare – helps them save money on health insurance expenses.

Florida uses the federally-run Health Insurance Marketplace: HealthCare.gov. Individual and family plans on the ACA exchange in Florida are available for: 1

Numerous private insurance companies offer coverage through the Florida Health Insurance Marketplace, with plan availability varying from one area to another. As detailed below, two additional carriers are joining the Florida Marketplace for 2025. Florida has by far the nation’s highest enrollment in Marketplace plans: A fifth of all Health Insurance Marketplace enrollees nationwide reside in Florida. 2

Florida banned surprise balance billing starting in mid-2016, for state-regulated health plans. 3 Florida’s law was lauded as a model for other states that wanted to implement similar consumer protections. The federal No Surprises Act took effect in 2022, providing nationwide protection from surprise balance bills, including for people with self-insured plans (which aren’t regulated by state laws).

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Florida.

Learn about Florida's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Florida as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Florida.

To qualify for Florida Health Insurance Marketplace coverage, you must: 1

But those rules just allow a person to enroll in coverage through the exchange. Eligibility for financial assistance (premium subsidies and/or cost-sharing reductions) through the Health Insurance Marketplace depends on how your household income compares with the cost of the second-lowest-cost Silver plan in your area.

In addition, to qualify for financial assistance with your Marketplace plan you must:

The open enrollment period to sign up for ACA-compliant individual and family health insurance in Florida runs from November 1 to January 15. 6

If you miss open enrollment, you can still enroll or switch plans if you meet the special enrollment period (SEP) requirements. Most SEPs require a qualifying life event like losing coverage, getting married, or permanently moving.

But some SEPs don’t require a qualifying life event. 7 For example:

People who lose Medicaid or CHIP between March 2023 and November 2024 may qualify for a temporary extended SEP. 9

To sign up for a Florida Health Insurance Marketplace plan, you have several enrollment options:

Go to localhelp.HealthCare.gov to find a navigator, certified application counselor, or agent in your area.

You can find affordable individual and family health insurance in Florida through HealthCare.gov, which is Florida’s ACA exchange/Marketplace.

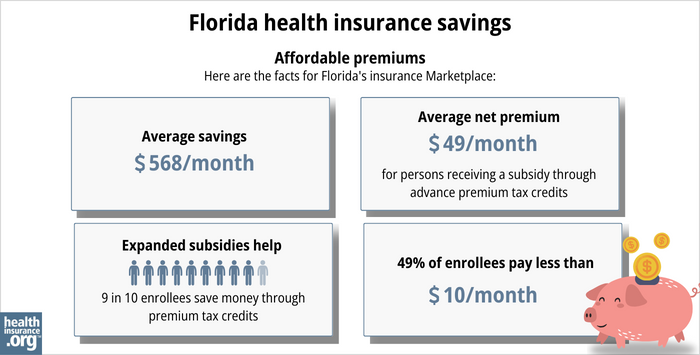

During 2023 open enrollment, more than 90% of Florida’s Health Insurance Marketplace enrollees qualified for subsidies. 11 These subsidies, called Advance Premium Tax Credits (APTC), lower your monthly premiums.

As of early 2024, nearly all — 98% — of Florida’s Marketplace enrollees were receiving premium subsidies. The subsidies averaged $567/month, and the average enrollee was paying about $60/month for their coverage after the subsidies were applied. 2

(The numbers above are based on effectuated enrollment in early 2024; the chart below is different because it illustrates some different metrics and uses data from all enrollments submitted during the open enrollment period for 2024.)

If your household income is between 100% and 250% of the federal poverty level and you select a Silver plan through the Florida Health Insurance Marketplace, you will also receive cost-sharing reductions (CSR). 12 63% of Florida’s Marketplace enrollees were receiving CSR benefits as of early 2024. 2

While APTCs help reduce health insurance costs, CSRs reduce out-of-pocket costs like deductibles, copayments, or coinsurance.

Medicaid and Florida KidCare (CHIP) are options for affordable health insurance in Florida if you qualify for either program.

Alternatively, short-term plans offer low-cost health coverage, for people who aren’t eligible for Medicaid or a Marketplace subsidy. These plans can also be used by people who missed the annual enrollment period for ACA-compliant coverage (short-term health insurance is much less robust than ACA-compliant coverage, and should not be considered an adequate substitute).

Fourteen insurers offer plans on Florida’s Marketplace for 2024. 14

Two additional insurers, Wellpoint and Simply Healthcare Plans, Inc, are joining Florida’s Marketplace for 2025. 15 16 17

In 2024, the average Florida Health Insurance Marketplace enrollee was paying about $60/month in premiums, after premium subsidies (premium tax credits) were applied. 2

The following average rate changes have been approved (before subsidies are applied) for 2025 for i ndividual/family plans sold through Florida’s Health Insurance Marketplace. They amount to an overall weighted average rate increase of 7.5%, 17 but that’s calculated before any subsidies are applied, and most enrollees get subsidies that change each year to keep pace with the cost of the benchmark plan.

Source: FLOIR (Florida Office of Insurance Regulation) 17

Remember that these rate changes are calculated before subsidies are applied. Most Florida exchange enrollees receive subsidies, so they may find coverage more affordable than expected. 2

For perspective, here’s a summary of how full price premiums in Florida’s ACA-compliant market have changed over the years:

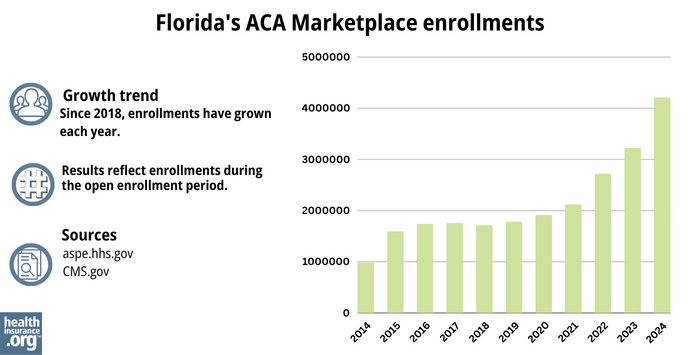

During the open enrollment period for 2024 coverage, a significant new record high of 4,211,902 people enrolled in health insurance through Florida’s Marketplace. 28

The previous record high, in 2023, had been 3,225,435, 29 so the increase for 2024 was substantial. (See chart below for a comparison of year-by-year enrollment.)

This surge in enrollment in recent years is due in part to the American Rescue Plan, which improved affordability starting in 2021. The Inflation Reduction Act then extended these improvements until 2025, ensuring coverage remains more affordable than it was before the ARP became law. 30

The 2024 enrollment spike is also due to the “unwinding” of the pandemic-era Medicaid continuous coverage rule. Medicaid disenrollments resumed in 2023 after a three-year pause, and some people who previously had Medicaid have transitioned to Marketplace coverage instead.

Source: 2014, 31 2015, 32 2016, 33 2017, 34 2018, 35 2019, 36 2020, 37 2021, 38 2022, 39 2023, 40 2024 41

Healthcare.gov

This is the ACA Marketplace, where you can enroll in a health insurance plan online. You may also get help by calling (800) 318-2596.

Florida Consumer Action Network (FCAN)

Nonprofit consumer advocacy group that helps Floridians understand their health insurance options.

Florida KidCare

Florida’s health insurance program for children.

FloridaHealthFinder.gov

State-run site to compare and enroll in health plans.

Florida Office of Insurance Regulation

Licenses and oversees health insurers, brokers, and agents. Helps consumers with complaints.

Medicare Rights Center

National service with a call center providing advice and information for people with Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.